@krays,

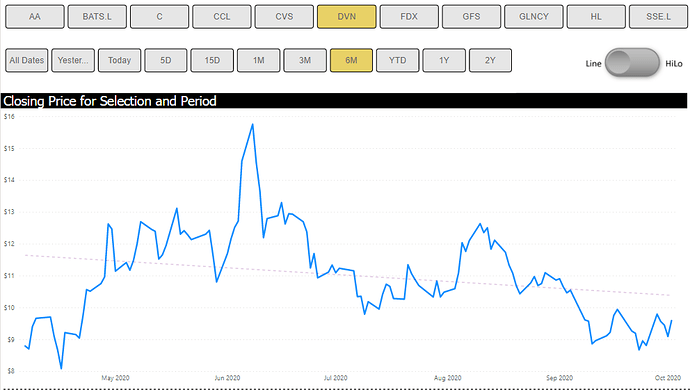

@JarrettM and I have got the period slicer and the dynamic two-year pull working like a champ. I haven’t had time to implement the chart type switcher, but that will be easy and I can do it tonight.

(UPDATE: Chart type switcher is implemented)

At this point, I think we need a clear definition of the specific conditions we’re looking for.

Thanks.

- Brian

StockList.xlsx (9.4 KB)

eDNA Forum - Chartist Stock Analysis v2 with Per Table and Dyn Date Query.pbix (875.3 KB)