@Krays23,

See if this works for you:

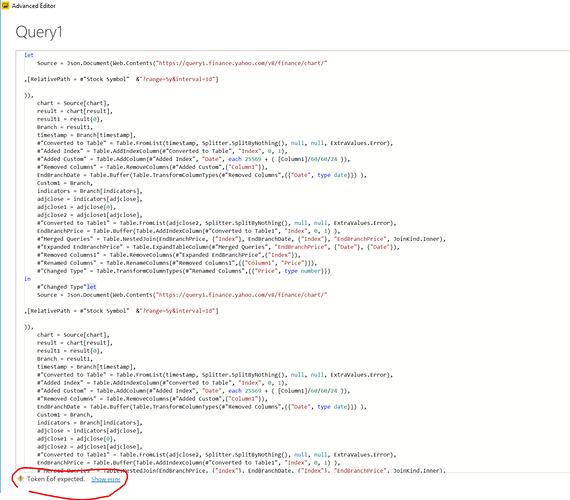

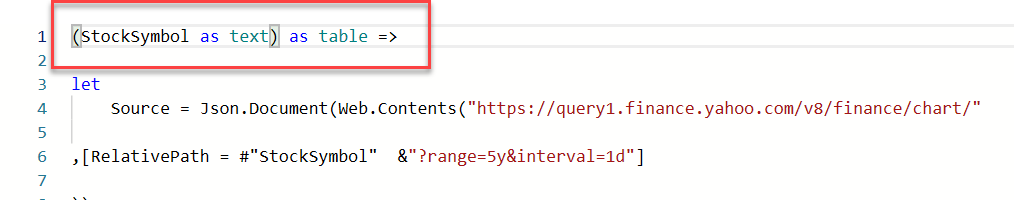

let

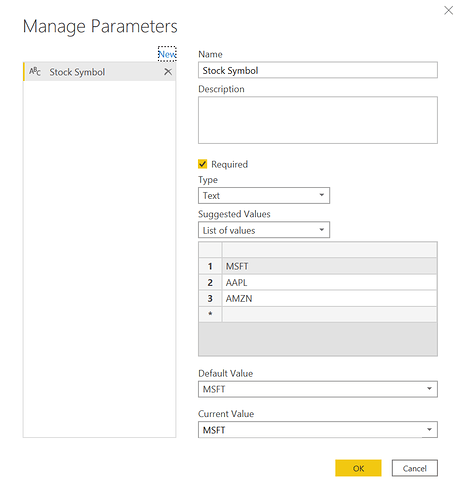

Source = Json.Document(Web.Contents("https://query1.finance.yahoo.com/v8/finance/chart/"

,[RelativePath = #"Stock Symbol" &"?range=5y&interval=1d"]

)),

chart = Source[chart],

result = chart[result],

result1 = result{0},

Branch = result1,

timestamp = Branch[timestamp],

#"Converted to Table" = Table.FromList(timestamp, Splitter.SplitByNothing(), null, null, ExtraValues.Error),

#"Added Index" = Table.AddIndexColumn(#"Converted to Table", "Index", 0, 1),

#"Added Custom" = Table.AddColumn(#"Added Index", "Date", each 25569 + ( [Column1]/60/60/24 )),

#"Removed Columns" = Table.RemoveColumns(#"Added Custom",{"Column1"}),

EndBranchDate = Table.Buffer(Table.TransformColumnTypes(#"Removed Columns",{{"Date", type date}}) ),

Custom1 = Branch,

indicators = Branch[indicators],

adjclose = indicators[adjclose],

adjclose1 = adjclose{0},

adjclose2 = adjclose1[adjclose],

#"Converted to Table1" = Table.FromList(adjclose2, Splitter.SplitByNothing(), null, null, ExtraValues.Error),

EndBranchPrice = Table.Buffer(Table.AddIndexColumn(#"Converted to Table1", "Index", 0, 1) ),

#"Merged Queries" = Table.NestedJoin(EndBranchPrice, {"Index"}, EndBranchDate, {"Index"}, "EndBranchPrice", JoinKind.Inner),

#"Expanded EndBranchPrice" = Table.ExpandTableColumn(#"Merged Queries", "EndBranchPrice", {"Date"}, {"Date"}),

#"Removed Columns1" = Table.RemoveColumns(#"Expanded EndBranchPrice",{"Index"}),

#"Renamed Columns" = Table.RenameColumns(#"Removed Columns1",{{"Column1", "Price"}}),

#"Changed Type" = Table.TransformColumnTypes(#"Renamed Columns",{{"Price", type number}})

in

#"Changed Type"let

Source = Json.Document(Web.Contents("https://query1.finance.yahoo.com/v8/finance/chart/"

,[RelativePath = #"Stock Symbol" &"?range=5y&interval=1d"]

)),

chart = Source[chart],

result = chart[result],

result1 = result{0},

Branch = result1,

timestamp = Branch[timestamp],

#"Converted to Table" = Table.FromList(timestamp, Splitter.SplitByNothing(), null, null, ExtraValues.Error),

#"Added Index" = Table.AddIndexColumn(#"Converted to Table", "Index", 0, 1),

#"Added Custom" = Table.AddColumn(#"Added Index", "Date", each 25569 + ( [Column1]/60/60/24 )),

#"Removed Columns" = Table.RemoveColumns(#"Added Custom",{"Column1"}),

EndBranchDate = Table.Buffer(Table.TransformColumnTypes(#"Removed Columns",{{"Date", type date}}) ),

Custom1 = Branch,

indicators = Branch[indicators],

adjclose = indicators[adjclose],

adjclose1 = adjclose{0},

adjclose2 = adjclose1[adjclose],

#"Converted to Table1" = Table.FromList(adjclose2, Splitter.SplitByNothing(), null, null, ExtraValues.Error),

EndBranchPrice = Table.Buffer(Table.AddIndexColumn(#"Converted to Table1", "Index", 0, 1) ),

#"Merged Queries" = Table.NestedJoin(EndBranchPrice, {"Index"}, EndBranchDate, {"Index"}, "EndBranchPrice", JoinKind.Inner),

#"Expanded EndBranchPrice" = Table.ExpandTableColumn(#"Merged Queries", "EndBranchPrice", {"Date"}, {"Date"}),

#"Removed Columns1" = Table.RemoveColumns(#"Expanded EndBranchPrice",{"Index"}),

#"Renamed Columns" = Table.RenameColumns(#"Removed Columns1",{{"Column1", "Price"}}),

#"Changed Type" = Table.TransformColumnTypes(#"Renamed Columns",{{"Price", type number}})

in

#"Changed Type"

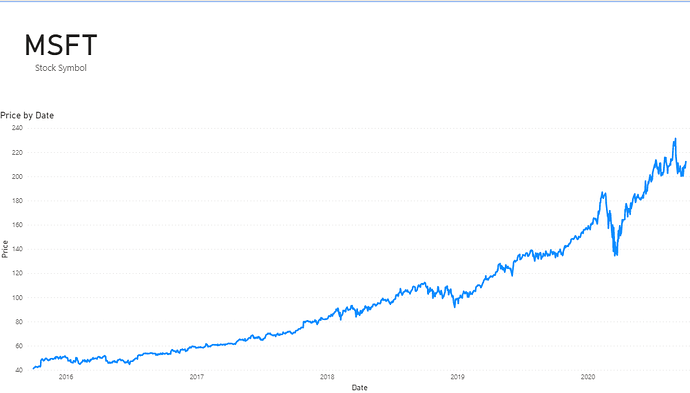

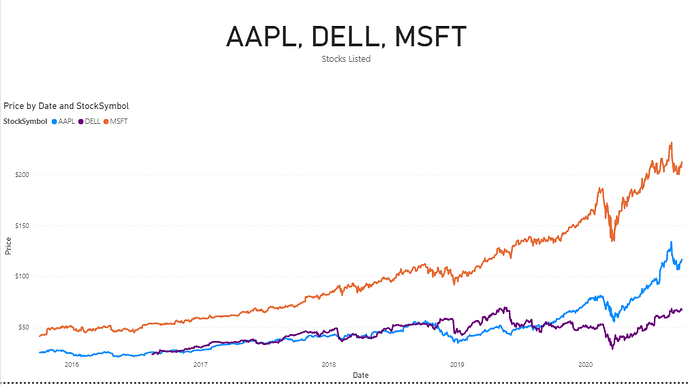

Solution based on this article:

https://powerbi.tips/2019/10/historical-stock-price-function-in-power-query/

Full solution file attached below. I hope this is helpful.