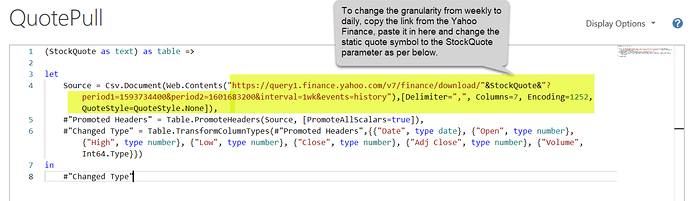

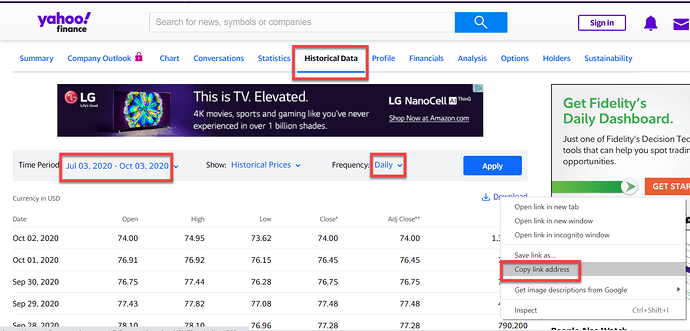

Here you go. I did the video at weekly granularity rather than daily, but here’s how to change it back to daily:

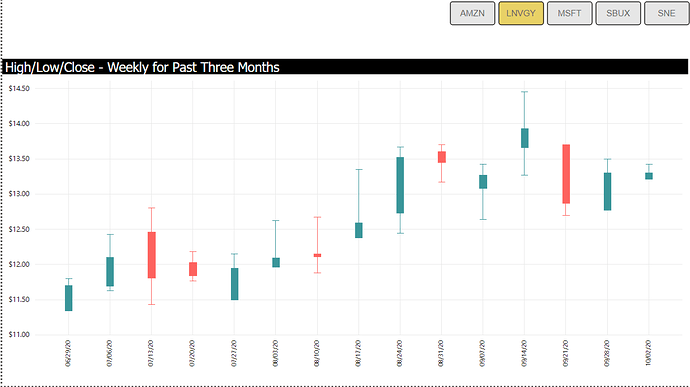

and here’s the visual:

The video hopefully will make this crystal clear. It has to go to the editor first, but I expect it will probably post late this week.

If we wanted to get fancy, we could also parameterize the granularity and the time period, so we wouldn’t have to go back to the Yahoo Finance site to do this, but I wanted to keep the video to a reasonable length. To do it, we’d just follow the exact same process used to parameterize the stock quote.

Hope you find this helpful.

- Brian

Video 11 - Dynamic Stock Quote App.pbix (433.5 KB)

StockList.xlsx (8.5 KB)

P,S, Here’s @Melissa’s awesome writeup of Challenge #5 entry explaining her pattern recognition algorithm:

and here’s her post with the recursive function she wrote but didn’t use for that entry (I think the Little League mercy rule got invoked, and the game got called when she was already up by 15 runs after three innings ![]() ):

):