Hello - I am trying to implement FIFO in share valuation. I was able to get it in excel, but not able to get the calculation in Power BI.

I have gone through the link on inventory - but could not utilize it for lack of clarity.

I am including the sample data (input and output) as was done in excel - gdrive link (https://drive.google.com/open?id=1vsc8R5MnGy2MVmqxUI7wgHssl6K6wjgM). The blue header columns in FINAL RESULT are the required output - I need help in creating these columns in Power BI - (a) CAPITAL GAIN (b) STOCK IN HAND (c) CLOSING VALUE

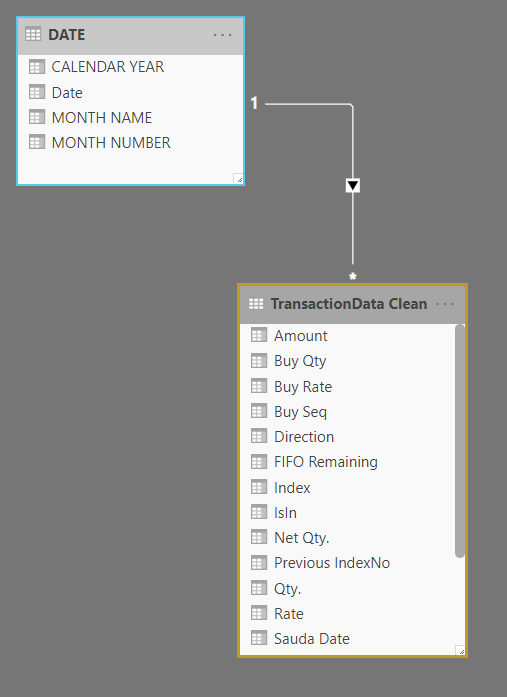

Also is the link for the PBX file (https://drive.google.com/open?id=1irJ2vOyV50WdVyYU45YQwA12rkqUNojm), where I am not able to fix the Calculated Column - “Cost Basis with FIFO”. Below is the DAX calculation for FIFO method that I am using - which is not working as per FIFO as it is not picking RATE (the multiplication factor) of the BUY QTY - rather it is picking the current row (SALE RATE), which is not the expected behavior of FIFO.

Cost Basis with FIFO =

VAR myUnits=[Qty.]

VAR PreviousBuys=

FILTER(TransactionData,

[IsIn]=EARLIER([IsIn])&&

[Sauda Date]<EARLIER([Sauda Date])&&

([Net Qty.] > 0)

)

VAR PreviousSales=

SUMX(

FILTER(TransactionData,

[IsIn]=EARLIER([IsIn])&&

[Sauda Date]<EARLIER([Sauda Date])&&

([Net Qty.] < 0)

),

[Qty.]

)

VAR PreviousBuysBalance=

ADDCOLUMNS(

ADDCOLUMNS(

PreviousBuys,

"Cumulative",

SUMX(

FILTER(PreviousBuys,

([Sauda Date]<=EARLIER([Sauda Date]))

),

[Qty.])

),

"Balance Left",

[Qty.]-IF([Cumulative]<PreviousSales,

[Qty.],

VAR PreviousCumulative=[Cumulative]-[Qty.]

RETURN

IF(PreviousSales>PreviousCumulative,PreviousSales-PreviousCumulative)

)

)

VAR CostUsed=

ADDCOLUMNS

(

ADDCOLUMNS

(

PreviousBuysBalance,

"MyCumulatives",

SUMX

(

FILTER(PreviousBuysBalance,

([Sauda Date]<=EARLIER([Sauda Date]))

),

[Balance Left])

),"Balance Used",

IF(

[MyCumulatives]<myUnits,[MyCumulatives],

VAR PreviousCumulatives=[MyCumulatives]-[Balance Left]

RETURN

IF(myUnits>PreviousCumulatives,myUnits-PreviousCumulatives)

)

)

RETURN

IF([Net Qty.] < 0,

([Qty.]*[Rate])-SUMX(CostUsed,([Balance Used]*[Rate])))

FIFO_SampleInput.xlsx (849.2 KB)

FIFO_SampleInput.pbix (378.7 KB)