Hello @pedroccamara,

You’re Welcome.

I’m really glad that I was able to help you.

So, now coming back to the query that you’ve asked. Here’s my answer pointers wise -

- Well with the first point of yours, I actually may agree/disagree depending upon the circumstances. So in my case what I would have done is edit the those names which contains the same naming convention within the same column. So let’s say I’ve - an Account Name as “Others” under the Assets side as well as under the Liabilities side. So what I’ll do is change the change as “Other - Assets” and “Other - Liabilities”. So by doing this I’ll save an effort of creating an extra columns. And another most, most important reason is the more columns you add, the deeper the columns/categories will get. That is, let’s say, right now you’ve three columns - Accounts, Sub-Accounts and Balances. By creating columns just to correct the naming conventions. Now, you may have - Accounts, Sub-Accounts, Sub-Sub-Accounts (or whichever name you may give in your case). And then more measures you’ll have to create for sub-totals in order to have one single total for Assets. For example -

In previous case, it the measure was as follows -

Assets = Current Assets + Fixed Assets + Other Assets

Here, you’ve to write only one measure for Other Assets. Now, if you add more columns the Other Assets column will get more deeper and deeper due to additional columns so then you’ll have to write more sub-measures to get the sub-totals for “Other Assets”

Note: It’s just an example that I’ve created in this scenario, you may different names in your accounts where the actual problem lies. But the concept/logic will absolutely remain the same.

-

For the second point, when you try to merge this tables with each other. The most important thing to remember over here is that, both the tables should contain same number of columns. (I presume you’ll use “UNION()” function to join/merge both these tables).

-

For third point, actually I was not able to understand the statement here. Where and how the conditional columns will be used? Out of which 6 columns 3 columns will be put to use?

-

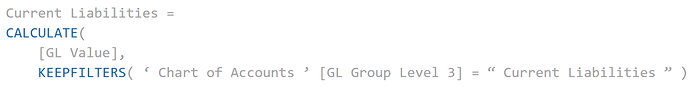

For fourth point, if you’ve created measures and sub-measures as I’d said i.e.

Assets = Current Assets + Fixed Assets + Other Assets

And

Equities and Liabilities = Owner’s Equity + Shareholder’s Funds + Current Liabilities + Long-Term Liabilities + Other Liabilities

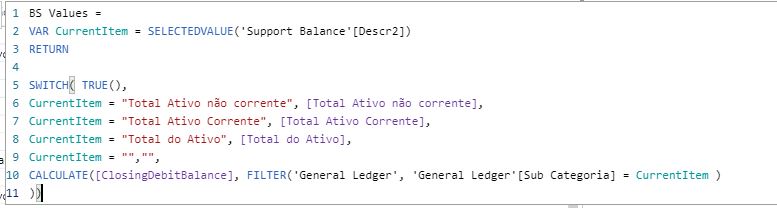

Then just put them in one master measure and these will be good to go. But as you said -

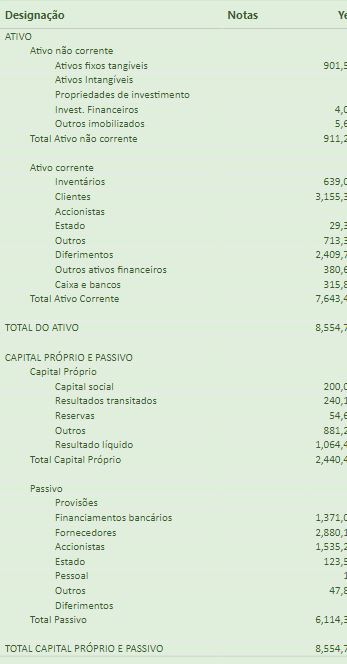

“Finally, Add a column (Balance Values) where if it’s assets, debit values, if blank, 0, else, credit values.” - If you’ve a template then how will you put /move the figures from the Balance Sheet to the Template? But if you’re not using a template and just showing values in a simple “Table” or “Matrix” then this option is I guess good to go. (But still adding a column should be a last option if this can be done via measure, just a thought. Not a compulsory option.)

I do understand that showing values as per the Financial Format is a very tedious process. But if you feel that the option you’ve will work (atleast for now) since you’ve to present the report in a given time frame then go for it. Absolutely not a viable option to make last minute changes because if the formulas are written hastily there could be a chance of committing an error and the numbers may not portray true picture and ultimately the report might collapse.

But for the next time, I guess you can go definitely go the points that I’ve suggested (If it seems viable to you).

I wish you all the very best for the project that you’re working on. And hope that you achieve the desired results or analysis that you’re looking for.

Still if you need any help from my side just give a shout and I’ll more or more than happy to assist you anytime.

And lastly, my sincerest thanks to you as well for your kinds words of appreciation and recognizing the efforts. Thank you, my friend.

Thanks and Warm Regards,

Harsh