Dear,

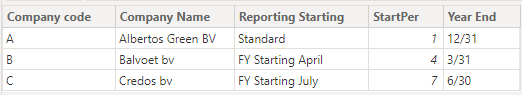

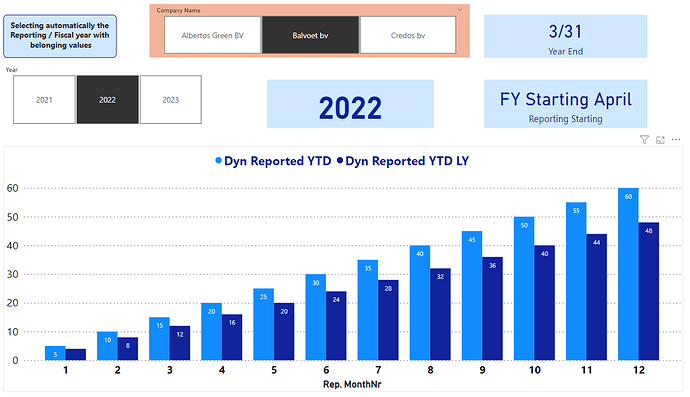

My report consists of accounting data for multiple companies with varying fiscal year-ends and fiscal periods (e.g. 4-period year => quarterly basis, 12-period year => monthly basis).

I am struggling to calculate the previous year amounts accurately as a result of the aforementioned differences in years and periods.

An important starting point where my judgment could already be flawed is that I thought it would not be possible to work with a ‘Date table’ given the wide variety of fiscal years/periods across a large number of companies included in the data (it is key that the top filter is company-based in order for the data to not get mixed up).

Currently I have defined a ‘Period ID’ (i.e. combination of client number + fiscal year + fiscal period) which is linked from a dim table (‘Client periods’ => extract of the general ledger fact table) to the fact table (‘General Ledger’) in a standard 1 to many relationship.

This works perfectly for the current year amounts.

For the previous year amounts, I created a ‘Period ID LY’ (i.e. combination of client number + fiscal year - 1 + fiscal period) which is also linked from the dim table (‘Client periods’) to the fact table (‘General Ledger’) in a standard 1 to many inactive relationship (Dim Client Periods - ‘Period ID LY’ => Fact General Ledger - ‘Period ID’).

In the previous year measure I simply use this inactive relationship to calculate the previous year amounts.

This all works fine as long as all periods across fiscal years remain the same (e.g. fiscal year 2022, period 4 => 2022-4 = 2021-4 => OK)

however when changes occur, the results are rendered useless (e.g. transition from quarterly periods in 2021 to monthly periods in 2022. fiscal year 2022, period 3 (i.e. March) => (Period ID) 2022-3 <> (Period ID LY) 2021-3 (i.e. July - September) => not OK).

Additional sidenotes:

- The date field of the general ledger (i.e. recording date) cannot be used since invoices of last year could be included in current year. As a result only the fiscal periods form a reliable basis in determining the correct amounts.

- The current slicer on the report page uses periods instead of dates and therefore only includes 4 items when the fiscal year consists of 4 periods. I like this approach since using a date field in the slicer would imply a full date range which could be confusing for users.

- The fiscal year slicer consists of the fiscal years included in the Dim table ‘Client periods’ and is therefore limited to the fiscal years applicable for the selected company. To my knowledge, including the ‘Year’ of a date table would imply that all years included in the date table are included in the slicer as well and therefore return years for which no data is available.

Do you see any other way to calculate the previous year amounts accurately? (both for each period separately and cumulatively)

Thank you for your time.

Financial reporting - Periods.pbix (489.3 KB)

The measue in which the last year amount is calculated is: ‘IS Actuals LY’