Hello EDNA community,

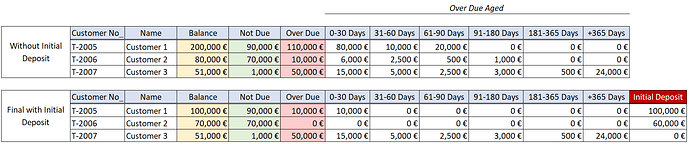

I’m looking for a solution in Power BI to build an Aging of Receivables report that can show balances as they were on a specific date selected in a slicer. For example, if I choose a date from three months ago, I should see the balance, overdue, not due, and aging breakdown as they were at that time.

I’ve been searching the forum, as well as with AI, but it’s a problem to find the solution. I need it in Power BI since I need to move in time.

In the table visual, I need the following columns:

Balance – Total outstanding amount

Over Due – Portion of the balance that is past due

Not Due – Portion of the balance that is not yet due

0–30 days – Overdue amount aged 0–30 days

31–60 days – Overdue amount aged 31–60 days

61–90 days – Overdue amount aged 61–90 days

91–180 days – Overdue amount aged 91–180 days

181–365 days – Overdue amount aged 181–365 days

+365 days – Overdue amount aged more than 365 days

Important logic details:

• Payments come in bulk and are not tied to specific invoice numbers.

• Needs to apply FIFO logic – credits should be applied starting from the earliest posting date, reducing debits accordingly.

• Once credits are exhausted, the remaining debits should be calculated into the Over Due and Not Due amounts.

• Over Due amounts should then be split into the aging buckets above, based on how old the debt is.

Additional condition that needs to apply:

• Every customer has an Initial Deposit value that is allowed to offset the balance (meaning the balance can be negative).

• This deposit should be subtracted from all calculations. For example, if the Over Due is 350,000 and the Initial Deposit is 100,000, then the displayed Over Due should be 250,000.

• The same logic should also apply to the aging buckets.

Attached is the .pbix and .xlsx files for reference.

Any suggestions or example measures/queries for implementing this logic will be highly appreciated or if you can write the dax on pbix and send to me I will be highly highly appreciated.

Thank you in advance!

Edip

Customer Ledger _T-2005.xlsx (52.5 KB)

Customer Ledger.pbix (123.1 KB)